We Produce Difference

with "Innovative solutions, seamless integration, robust security, agile development, 24/7 support"

Website Development

Elevate your online presence with our expert website development services. At Whiz Developers, we craft visually stunning and functionally seamless websites tailored to your unique brand identity. Our team of skilled developers utilizes cutting-edge technologies to ensure a responsive and user-friendly experience across all devices.

Loan Management System

"Revolutionize your financial operations with our cutting-edge loan management software. Streamline processes, enhance efficiency, and ensure compliance with our customizable solution. From application to repayment, our software simplifies the entire loan lifecycle. Gain a competitive edge in the lending industry with our robust and user-friendly platform."

API Integration

"Streamline your operations with seamless API integration for your website or software. Our robust solution ensures smooth communication between systems, enabling real-time data exchange, enhanced functionality, and improved user experience. Unlock the power of connectivity and stay ahead in the digital landscape with our reliable API integration services.""

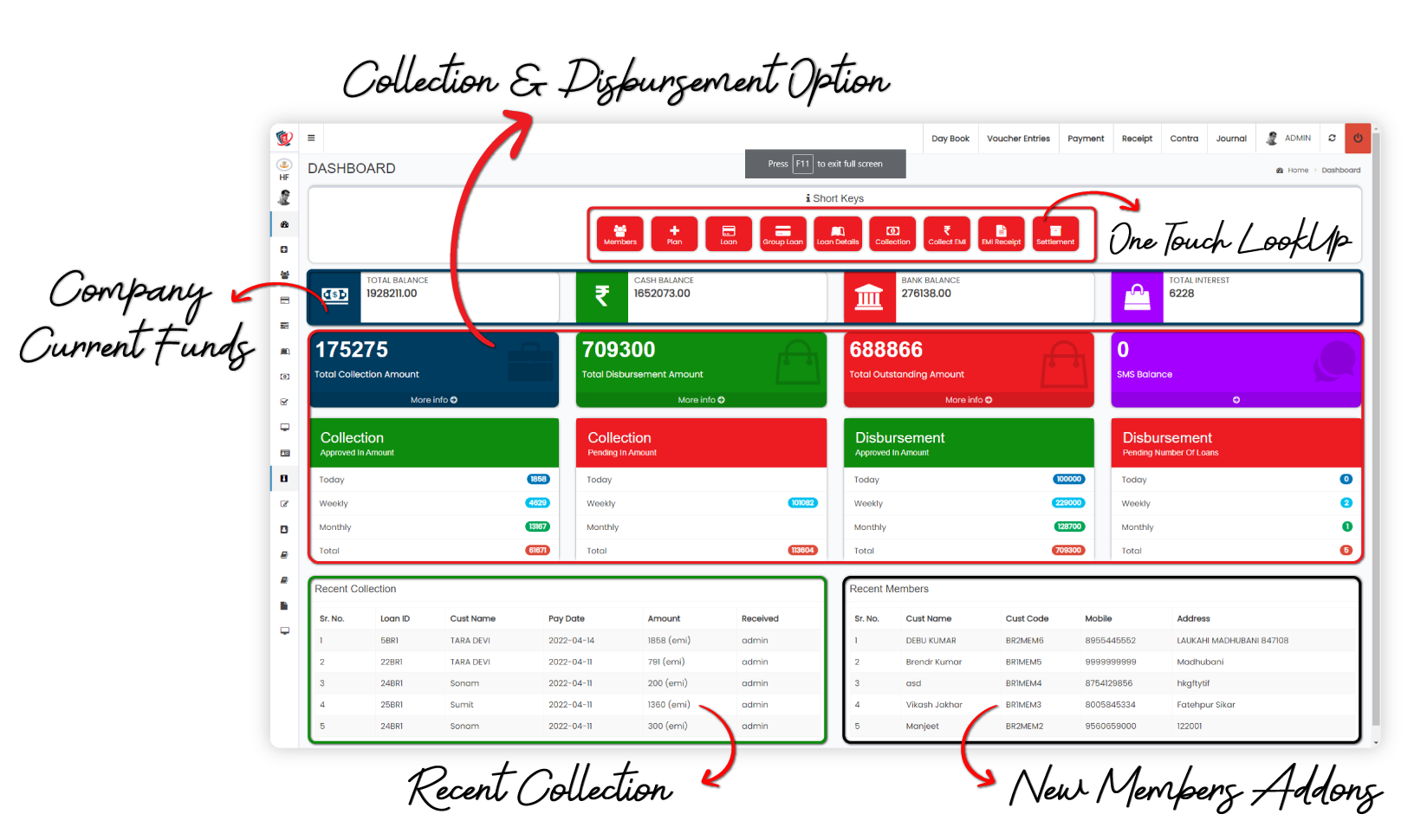

Highlights of

Loan Management Software

Why MicroMuneem As Loan Management Software?

-

Access Data Anytime

-

Track Field Recovery Executive

-

Create Loans as per your Business Module

-

Best Security features

-

Easy Accounting

-

Profit & Loss Statement

-

Loan Transfer

-

Seamless Reporting Module

-

and much more….

Process

How to use MicroMuneem Microfinance Software?

By following these steps and leveraging the full capabilities of MicroMuneem microfinance software, your MFI can streamline operations, improve efficiency, and better serve your clients' financial needs.

-

Step 1

Add Loan Plans

Create Loan Plans based on your Microfinance Company's structure from the numerous options provided under the Loan Plan Option in the MicroMuneem Microfinance Software.

-

Step 2

Add Employee Details

Once the Loan Plans are created, you can now start enrolling your employees by filling out their information in the Employee Section in the Loan Management Software. Based on the "Role" provided, your staff can now login with the credentials assigned to them.

-

Step 3

Add Customer Details & KYC

Customer details are to be added in the Member Section in the Loan Management Software. After filling in the basic details are placed, you can upload the KYC Documents in the software itself. Once the Customer's KYC is Verified, he/she is now eligible to take a loan from your Microfinance Company.

-

Step 4

Create & Disburse Customer Loans

Use the MicroMuneem Microfinance software to process loan applications efficiently. Loan Pre-Sanction Letter, Loan Agreement Form, Loan EMI Card, and Demand Promissory Note are created once the loan is disbursed from the system.

-

Step 5

Start Collecting EMIs & Check Reports

Upon the due date, the customer's Due EMI information is shown to the assigned Employees in the EMI Records in the Microfinance Software. Your employee can collect EMIs and enter their details through the Login panel allotted to them. This makes collection efficient & easy.

Testimonial

WHAT CLIENTS SAY ABOUT US

Let's Try! Get Free Support

Start Your 7-Day Free Trial

Free Microfinance Software Demo

Unlocking Efficiency and Growth

Whizdevelopers Features

Te maiorum pericula neglegentur sit, pro fabulas iracundia ad. Ne vim facilis feugait moderatius, nec eu perpetua scriptorem referrentur. Ut alii delicata mei.

Comprehensive Website Development Services

Skilled in creating dynamic and responsive websites tailored to clients' needs. Expertise in various web development frameworks and technologies.

Loan Management Software Expertise

Specialized in designing, developing, and maintaining loan management systems. Knowledgeable about financial regulations and compliance standards.

API Integration Capabilities

Proficient in integrating APIs to enhance the functionality of websites and applications. Experience working with popular APIs relevant to the finance and web development industries.

Cross-Platform Compatibility

Ability to develop solutions that work seamlessly across different platforms and devices.

Security and Compliance

Focus on implementing robust security measures to protect sensitive financial data. Adherence to industry-specific regulations and compliance standards.

Scalability and Performance Optimization

Designs systems that can scale with growing business needs. Optimizes performance for faster loading times and efficient resource utilization.

Customization and Flexibility

Offers customizable solutions to meet the unique requirements of clients. Flexibility in adapting to changing business needs and technological advancements.

User Experience (UX) Design

Emphasis on creating user-friendly interfaces for websites and software applications. Conducts usability testing to ensure a positive user experience.